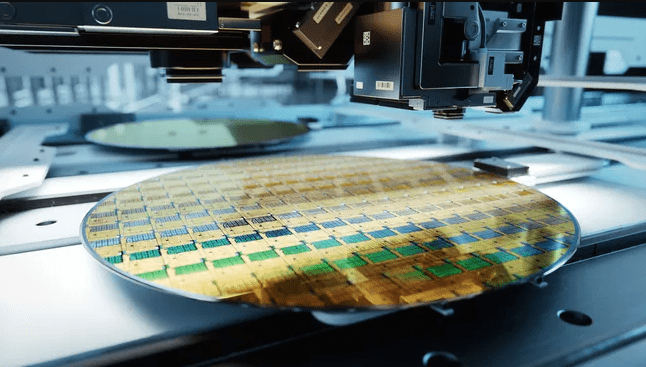

TSMC's N3 Technology Drives 22% Spike in Wafer Prices, Reshaping Semiconductor Industry Growth

Introduction: In the ever-evolving landscape of the semiconductor industry, Taiwan Semiconductor Manufacturing Company (TSMC) has seen a remarkable 22% increase in the average selling price (ASP) of its 300-mm wafers in just one year. This surge in prices is attributed to the successful ramp-up of TSMC's cutting-edge N3 (3nm-class) process technology. While global chip demand may not be at its peak, the semiconductor market is experiencing a significant shift, with higher prices for advanced technologies playing a pivotal role in driving industry growth.

TSMC's Q4 2023 Performance: Despite a decline in wafer shipments – a notable drop from 3,702 million in Q4 2022 to 2,957 million in Q4 2023 – TSMC's net revenue for the fourth quarter of 2023 reached $19.62 billion, demonstrating only a marginal 1.5% decrease from the previous year's $19.93 billion. This divergence between wafer shipments and revenue highlights a crucial trend in the semiconductor sector – the increasing reliance on elevated pricing rather than sheer production volume.

N3 Technology's Impact: The rise in wafer prices is primarily linked to TSMC's N3-based wafer shipments to key clients, including tech giant Apple. Analysts speculate that TSMC may charge as much as $20,000 per wafer processed with its N3 technology, showcasing the premium pricing attached to cutting-edge semiconductor nodes. In Q4 2023, 15% of TSMC's wafer revenue was generated from N3 technology, amounting to $2.943 billion.

Semiconductor Industry Growth Dynamics: Stacy Rasgon, a senior analyst at Bernstein Research, emphasizes that the semiconductor industry's growth is now predominantly fueled by increased pricing rather than a surge in processor shipments. Despite a decline in the total number of chips shipped from 2019 to 2023, the average selling price (ASP) has seen a substantial rise. Newer process node technologies are becoming progressively more expensive, reshaping the revenue landscape for chip manufacturers.

Revenue Distribution: TSMC's advanced technology nodes, including N7, N5, and N3, accounted for 67% of its total wafer revenue in Q4 2023. Notably, N5 technology contributed $6.867 billion, while N7 technology yielded $3.3354 billion. A broader category, encompassing all FinFET-based process technologies, constituted 75% of TSMC's wafer sales.

Market Segmentation: Despite the traditional dominance of smartphone system-on-chips (SoCs), TSMC's Q4 2023 revenue shares for SoCs used in smartphones and high-performance computing applications were both at 43%. Automotive chips and Internet-of-Things (IoT) chips each contributed 5% to the revenue, showcasing a diversification of TSMC's client base.

Conclusion: In conclusion, TSMC's success in driving up wafer prices through the adoption of advanced technologies, particularly the N3 process node, is reshaping the dynamics of the semiconductor industry. The shift towards premium pricing for cutting-edge nodes signifies a strategic move towards profitability over sheer production volume. As TSMC continues to innovate and cater to high-profile clients like Apple, the semiconductor landscape is evolving, with pricing emerging as a key driver of industry growth.

Keyleer Automation Solutions is at the forefront of technological advancements, providing innovative automation solutions for a smarter future.