Unveiling the Silicon Success: 3 Chip Stocks Poised for 2024 Triumph

In the dynamic landscape of technology, the heartbeat of innovation often lies within the realm of semiconductor companies. As we step into 2024, the stage is set for some chip stocks to shine brighter than ever before. At Keyleer Automation Solutions, as independent distributors of electronic components, we're always on the lookout for trends and opportunities that benefit our clients. Today, we're excited to highlight three chip stocks that are primed for success in the year ahead.

Advanced Micro Devices (AMD)

AMD has been a consistent player in the semiconductor industry, known for its high-performance computing and graphics solutions. With the ongoing demand for gaming consoles, data centers, and PC components, AMD stands at the forefront of innovation. Their recent advancements in AI and machine learning technologies further solidify their position in the market. As the world continues to digitize, AMD's products are poised to experience heightened demand, translating into promising growth opportunities for investors.

NVIDIA Corporation (NVDA)

Renowned for its graphics processing units (GPUs) and AI technologies, NVIDIA remains a powerhouse in the semiconductor arena. The convergence of gaming, AI, and autonomous vehicles presents a vast playground for NVIDIA's offerings. Their graphics cards are not only coveted by gamers but also find applications in data centers for high-performance computing tasks. With the increasing adoption of AI across industries, NVIDIA's data center segment is expected to witness substantial growth. Additionally, their foray into automotive computing positions them strategically in the era of autonomous driving.

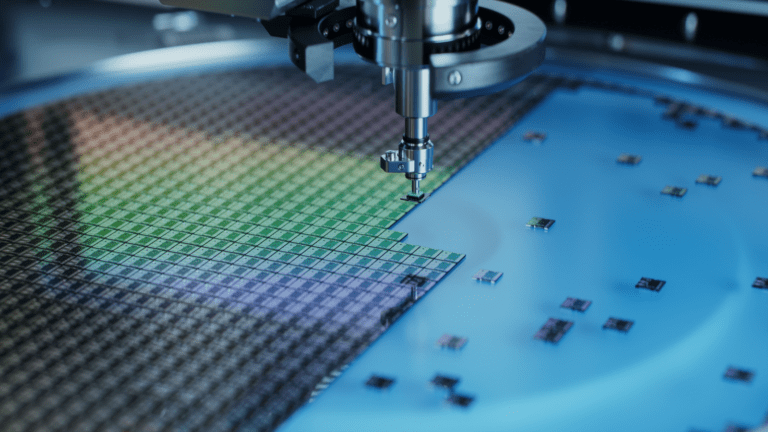

Taiwan Semiconductor Manufacturing Company (TSMC)

As the world's largest dedicated independent semiconductor foundry, TSMC plays a pivotal role in enabling technological advancements. The company's cutting-edge fabrication processes cater to a diverse clientele, ranging from leading-edge tech giants to emerging startups. Amid the global semiconductor shortage, TSMC's expertise in manufacturing advanced chips places them in a favorable position. Furthermore, their investments in next-generation technologies like 5G and IoT reaffirm their commitment to staying ahead of the curve. As the demand for semiconductors continues to surge, TSMC stands ready to meet the needs of an evolving digital landscape.

In conclusion, the future looks bright for chip stocks in 2024, and these three companies are well-positioned to capitalize on emerging opportunities. At Keyleer Automation Solutions, we recognize the importance of staying abreast of industry trends to better serve our clients. Whether you're in need of electronic components for consumer electronics, industrial automation, or IoT devices, we're here to provide tailored solutions to meet your requirements. Stay tuned as we continue to navigate the ever-evolving world of technology together.

a financial advisor before making investment decisions.